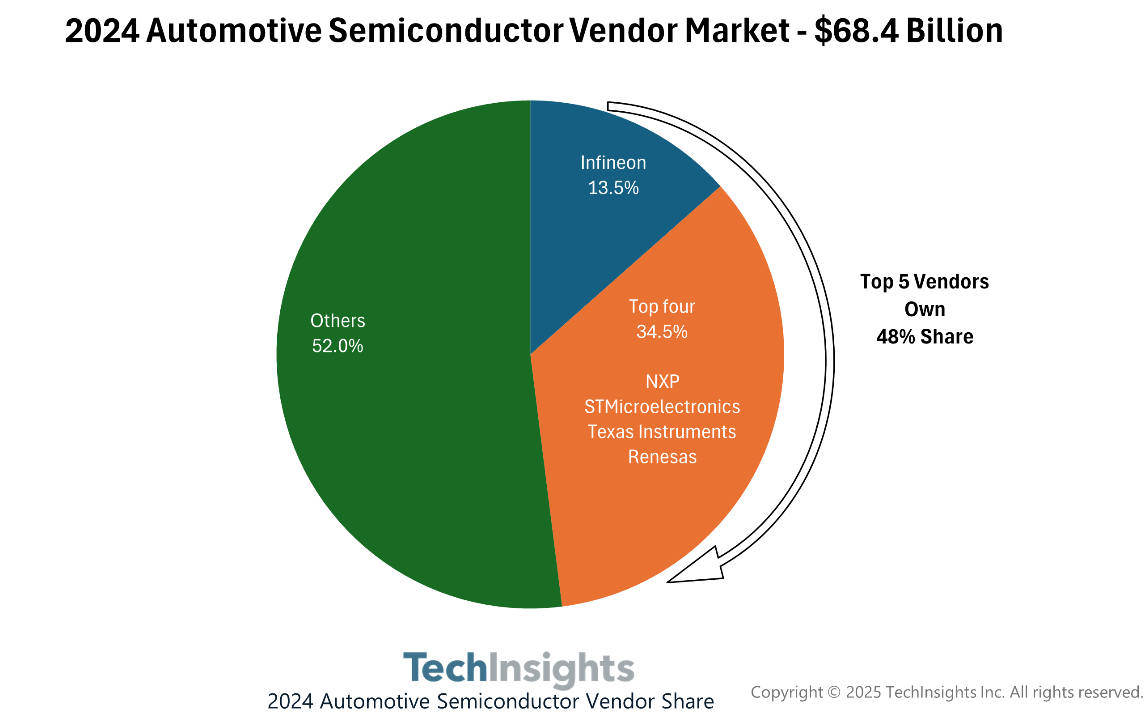

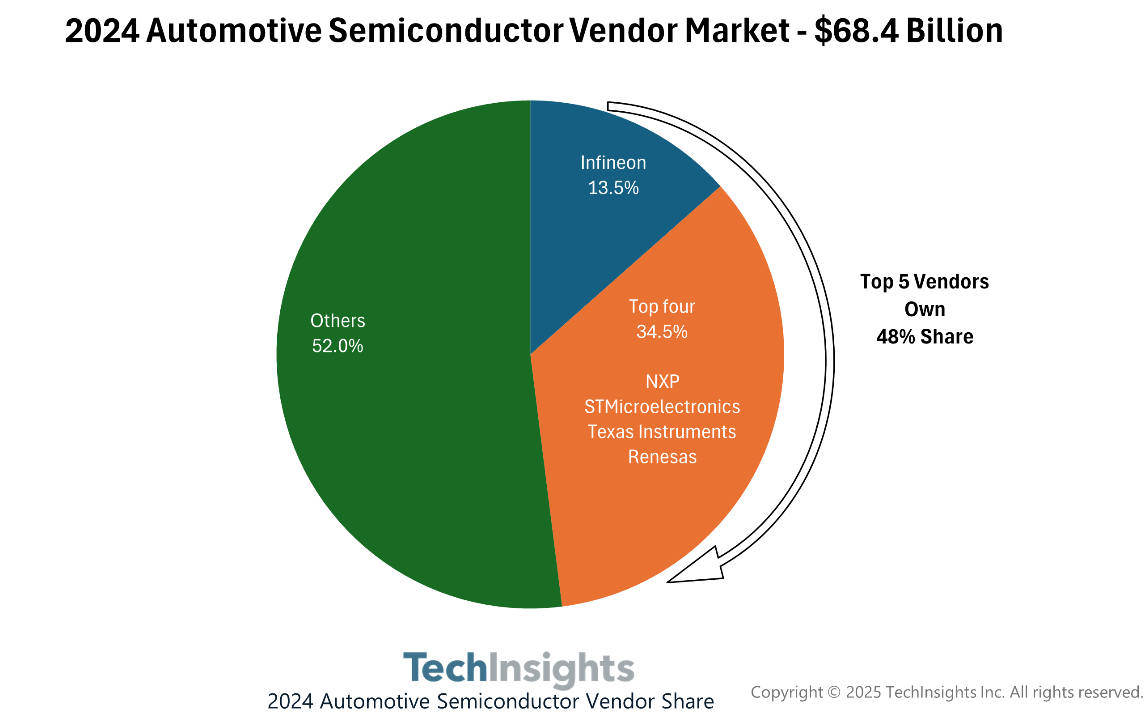

The global automotive semiconductor market experienced a slight downturn in 2024, with total supplier revenue declining by 1.2% year-on-year. According to data released by research firm TechInsights, the industry's revenue dropped from $69.2 billion in 2023 to $68.4 billion in 2024. Despite this marginal decline, the sector remains dominated by a few major players, showcasing a high level of concentration.

Top 10 Automotive Semiconductor Suppliers in 2024

Based on TechInsights’ annual evaluation of market share, the top ten automotive semiconductor suppliers in 2024 were:

Infineon – 13.5% market share

NXP Semiconductors – 10.4%

STMicroelectronics – 8.8%

Texas Instruments – 8.4%

Renesas Electronics – 6.8%

onsemi

Micron

Qualcomm

Bosch

Analog Devices

The combined market share of the top five vendors amounts to nearly 48%, highlighting a relatively concentrated supply landscape in the automotive semiconductor segment. This concentration suggests stability but also hints at potential vulnerabilities in the supply chain, especially when leading suppliers face production or geopolitical challenges.

Positive Forecast for 2025

Looking ahead, the outlook for 2025 appears far more optimistic. Two major research firms have shared bullish projections:

Gartner anticipates the global automotive chip market will surge to $80 billion.

Omdia forecasts a slightly higher figure, estimating $80.4 billion for automotive-grade chip demand in 2025.

Both predictions suggest strong recovery and growth potential, driven by multiple factors:

Continued electrification of vehicles (EVs and hybrids)

Expansion of Advanced Driver Assistance Systems (ADAS)

Growth in infotainment and connectivity technologies

Rising demand for energy-efficient and AI-capable chips

Industry Implications: What Do These Trends Tell Us?

The slight dip in 2024 should be seen in the broader context of long-term transformation. The automotive sector is undergoing rapid technological evolution, and semiconductors lie at the heart of this transition. The predicted rebound in 2025 indicates resilient demand, especially as vehicles become increasingly "software-defined" and reliant on complex chips for safety, intelligence, and connectivity.

For industry players, the message is clear: innovation, strategic partnerships, and supply chain agility will be key to riding the next wave of growth. The competition among top-tier suppliers is intensifying, but so are the opportunities.

What’s your view? Do you think the automotive semiconductor market will meet these ambitious projections in 2025? What challenges or trends do you foresee that might impact this trajectory?

Let us know your thoughts in the comments or connect with us for deeper industry insights.

MCU Solutions

MCU Solutions PCBA Solutions

PCBA Solutions Bluetooth Solutions

Bluetooth Solutions

FAQ

FAQ Contact Us

Contact Us

Company News

Company News Technology News

Technology News Industry News

Industry News PCBA News

PCBA News

Company Profile

Company Profile Certificates

Certificates Terms & Conditions

Terms & Conditions Privacy Statement

Privacy Statement

Home Appliances

Home Appliances Beauty Appliances

Beauty Appliances Lighting

Lighting Kid's Toys

Kid's Toys Security Alarm

Security Alarm Health Care

Health Care

More information?

More information?