Introduction

The first half of 2025 has brought a clear picture of the global semiconductor distribution landscape, as the world’s TOP 4 distributors—WPG Holdings, WT Microelectronics, Arrow Electronics, and Avnet—have all reported solid revenue growth in Q2. This positive momentum reflects a recovering electronics supply chain, strong AI-related demand, and rising memory prices.

In this report, we break down the latest rankings, revenue performance, regional growth patterns, and the key market drivers shaping the rest of 2025.

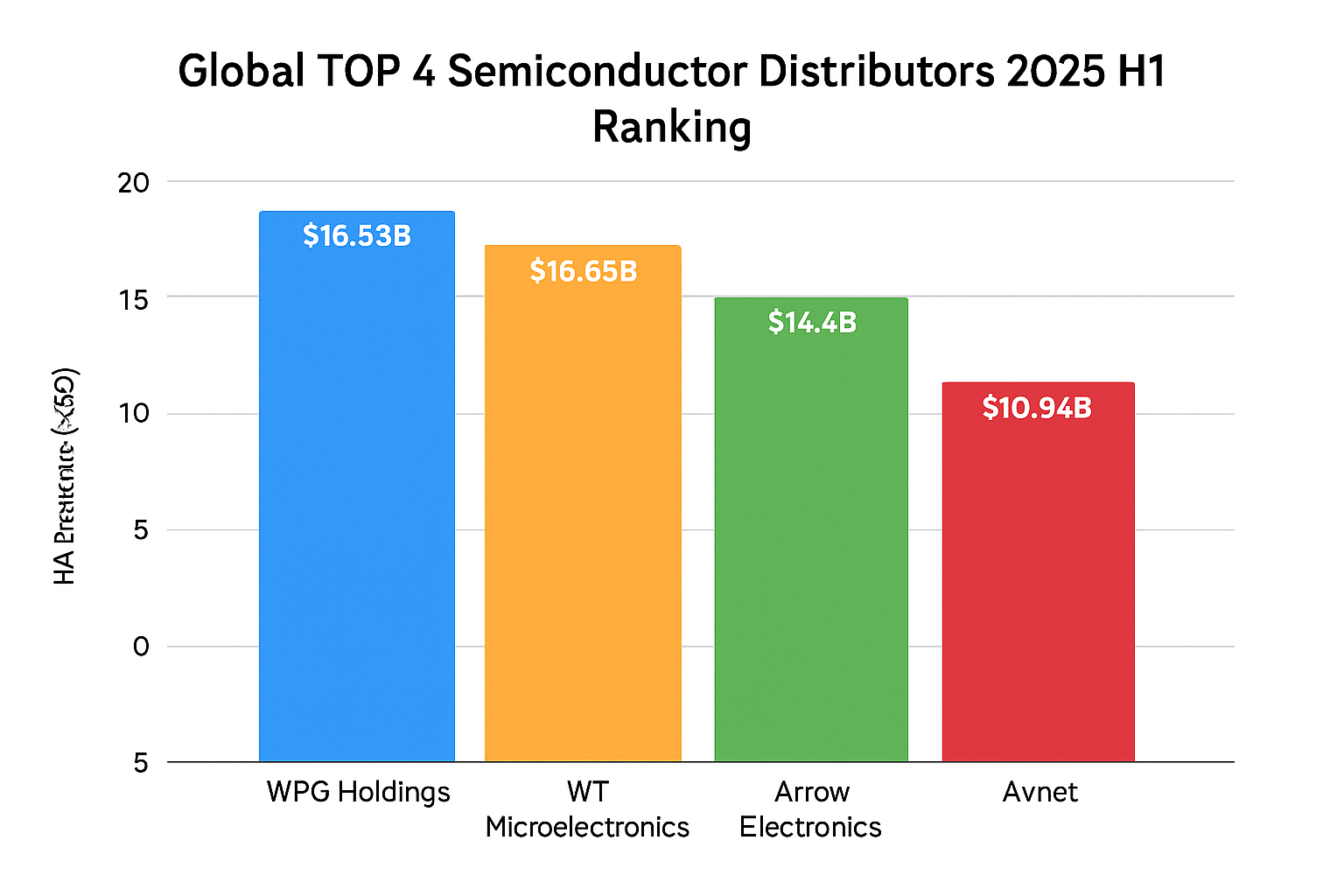

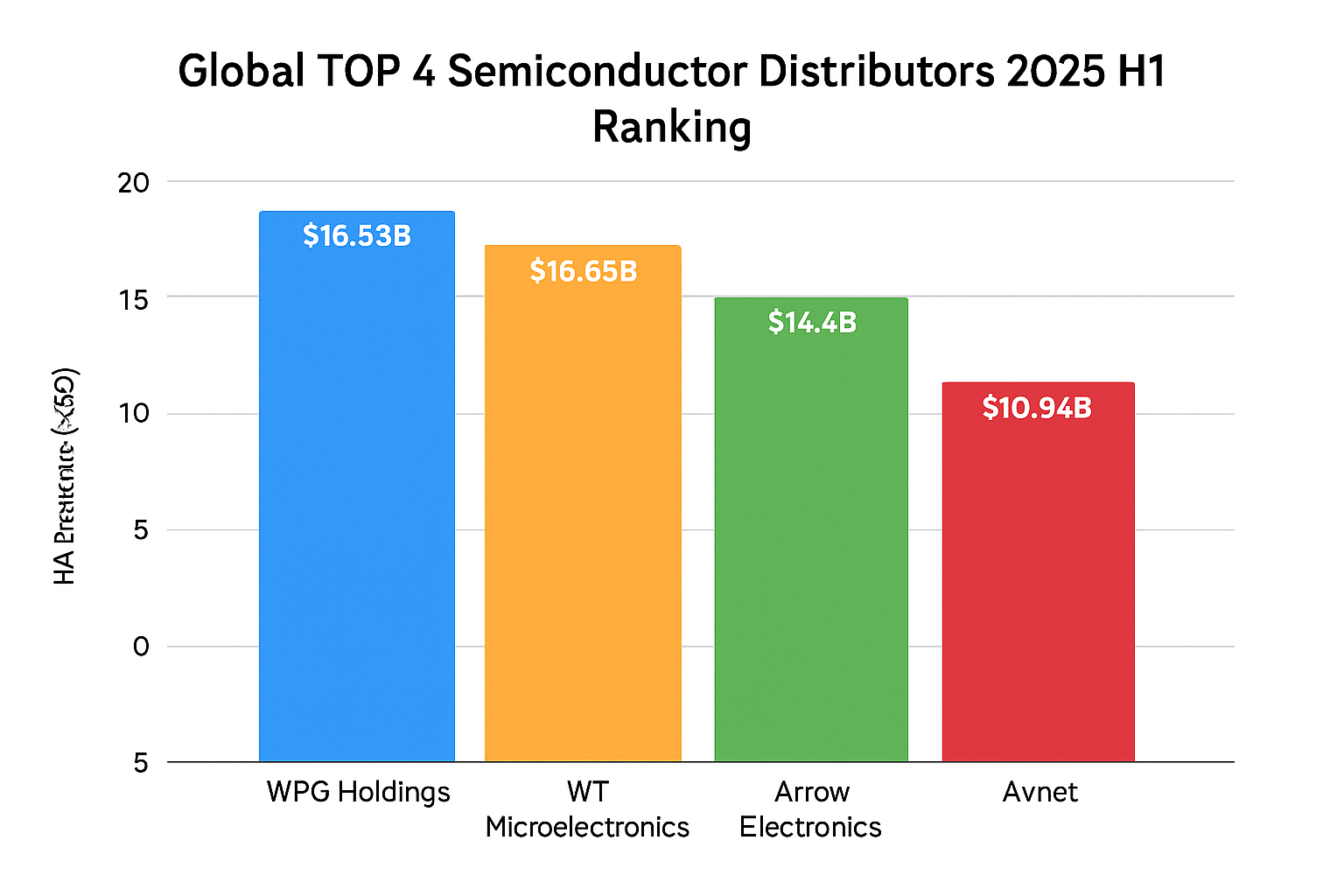

1. 2025 H1 Global Ranking by Revenue

Based on total H1 2025 sales, the global semiconductor distribution ranking is as follows:

| Rank | Company | H1 2025 Revenue (USD) | YoY Growth |

|---|

| 1 | WPG Holdings | $16.93B | +16.19% |

| 2 | WT Microelectronics | $16.68B | +28.1% |

| 3 | Arrow Electronics | $14.4B | +10% |

| 4 | Avnet | $10.94B | +1% |

The gap between WPG and WT is now just $2.56B, indicating a fierce competition for the No.1 position.

2. Q2 2025 Revenue Highlights

* WPG Holdings – $8.7B, up 5% QoQ, up 7% YoY; driven by strong AI server and data center demand.

* WT Microelectronics – $8.4B, up 0.65% QoQ, up 20.4% YoY; boosted by memory (DDR4/DDR5, HBM) and AI hardware sales.

* Arrow Electronics – $7.6B, up 12% QoQ, up 10% YoY; first YoY growth in global components since 2022.

* Avnet – $5.62B, up 5.7% QoQ, up 1% YoY; Asian market up 18%, EMEA market down 17%.

3. H1 2025 YoY Growth Comparison

WT Microelectronics outpaced all competitors with 28.1% YoY growth, compared to WPG’s 16.19%. Arrow posted a healthy 10% gain, while Avnet saw modest improvement at 1%.

4. Key Market Drivers in H1 2025

AI Infrastructure Boom

Both WPG and WT reported increased demand for AI servers, data center components, and networking equipment. WT also benefited from the transition to DDR5 memory and a surge in HBM shipments.

Memory Price Recovery

Global DRAM and NAND prices saw an upward trend in early 2025, improving margins for distributors with strong storage portfolios—particularly WT Microelectronics.

Regional Demand Differences

* Asia-Pacific – Strongest growth for both Avnet (+18%) and Arrow (+6%).

* Americas – Solid recovery for Arrow (+9% YoY in components).

* EMEA – Still lagging; both Avnet and Arrow reported YoY declines.

5. Competitive Dynamics: WPG vs. WT

While WPG remains No.1, WT’s faster YoY growth (+28% vs. WPG’s +16%) suggests it could potentially close the gap further in H2 2025. WT’s product mix—heavier in PC, NB, and communications electronics—contrasts with WPG’s focus on data centers, smartphones, and telecom.

In June 2025, WT’s revenue grew 14.9% YoY, while WPG saw a 17% YoY decline, attributed to shipment schedule changes rather than demand weakness. However, WPG’s loss of the ADI agency rights earlier this year may have also impacted growth.

6. Industry Outlook for H2 2025

According to SIA data, global semiconductor sales in Q2 2025 reached $179.7B (+7.8% QoQ, +20% YoY). WSTS reports the H1 2025 semiconductor market at $346B, up 18.9% YoY.

Key expectations for H2 2025:

* Continued AI infrastructure and storage demand.

* Gradual recovery in industrial and automotive electronics.

* Possible seasonal uptick from consumer electronics ahead of year-end sales.

* Regional divergence—Asia and the Americas to lead growth, EMEA to remain weaker.

Conclusion

The semiconductor distribution industry has clearly entered a mild recovery phase in 2025. All TOP 4 players—WPG, WT, Arrow, and Avnet—posted positive Q2 growth, with AI and memory segments leading the charge. The race for the top spot between WPG and WT will be the key storyline for the rest of the year, while global market momentum looks set to continue into 2026.

MCU Solutions

MCU Solutions PCBA Solutions

PCBA Solutions Bluetooth Solutions

Bluetooth Solutions

FAQ

FAQ Contact Us

Contact Us

Company News

Company News Technology News

Technology News Industry News

Industry News PCBA News

PCBA News

Company Profile

Company Profile Certificates

Certificates Terms & Conditions

Terms & Conditions Privacy Statement

Privacy Statement

Home Appliances

Home Appliances Beauty Appliances

Beauty Appliances Lighting

Lighting Kid's Toys

Kid's Toys Security Alarm

Security Alarm Health Care

Health Care

More information?

More information?